Income Tax Calendar Ay 2026-26 Foremost Notable Preeminent. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor.

A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. Filing taxes can feel overwhelming, especially with so many dates to keep track of. This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor.

Source: michaelbmarshall.pages.dev

Source: michaelbmarshall.pages.dev

Tax Calculator Ay 2025 26 Excel Sheet Michael B. Marshall Filing taxes can feel overwhelming, especially with so many dates to keep track of. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026.

Source: taxfilingschool.com

Source: taxfilingschool.com

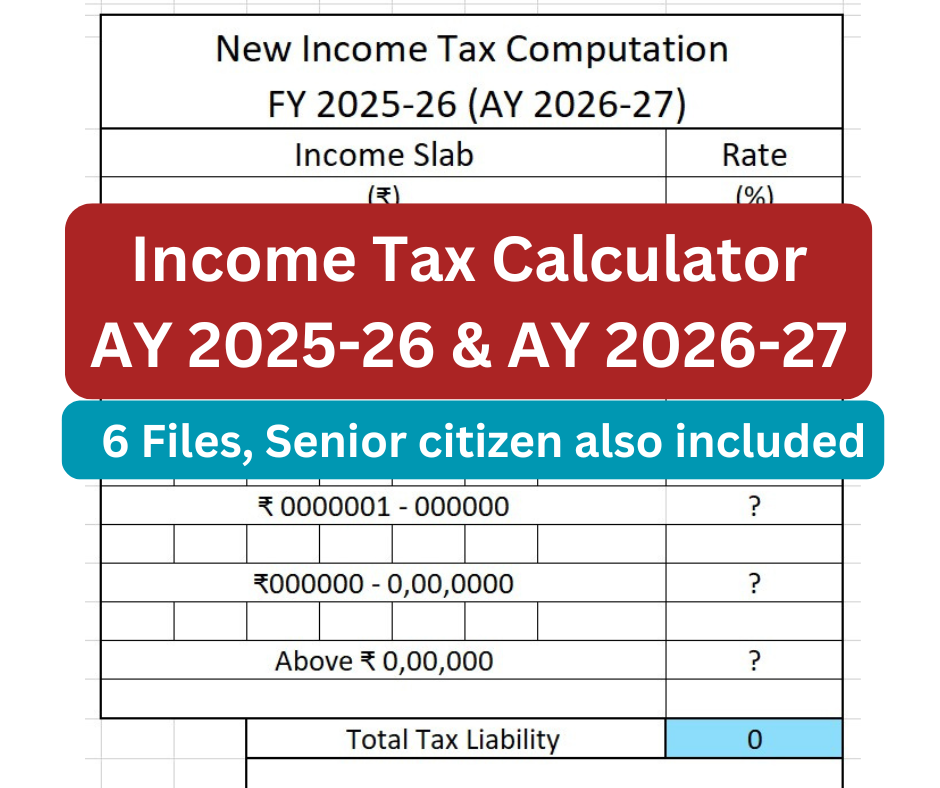

Tax Calculator AY 202526 & AY 202627 For Salaried (Educational A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor.

Source: taxzone.in

Source: taxzone.in

Tax Slab FY 20252026 This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor. Filing taxes can feel overwhelming, especially with so many dates to keep track of.

Source: eroppa.com

Source: eroppa.com

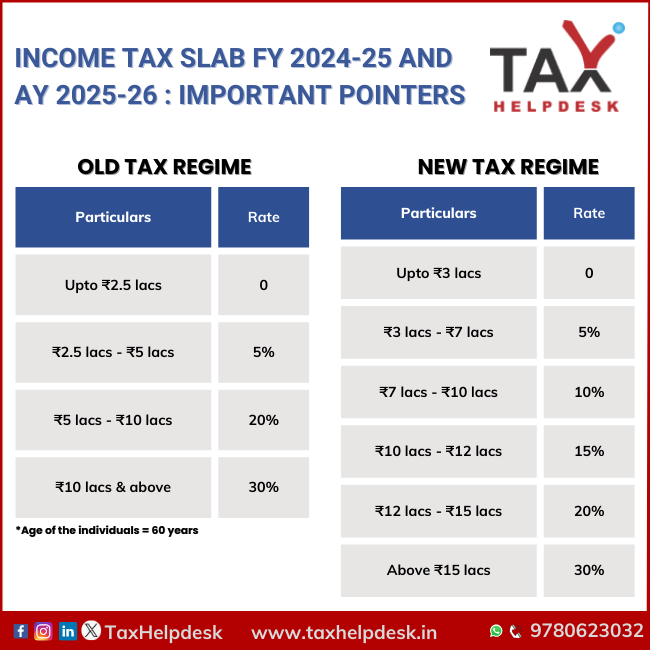

New Tax Slab Rates Fy 2024 25 Ay 2025 26 By Budget 2024rebate U This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor. Filing taxes can feel overwhelming, especially with so many dates to keep track of.

Source: eroppa.com

Source: eroppa.com

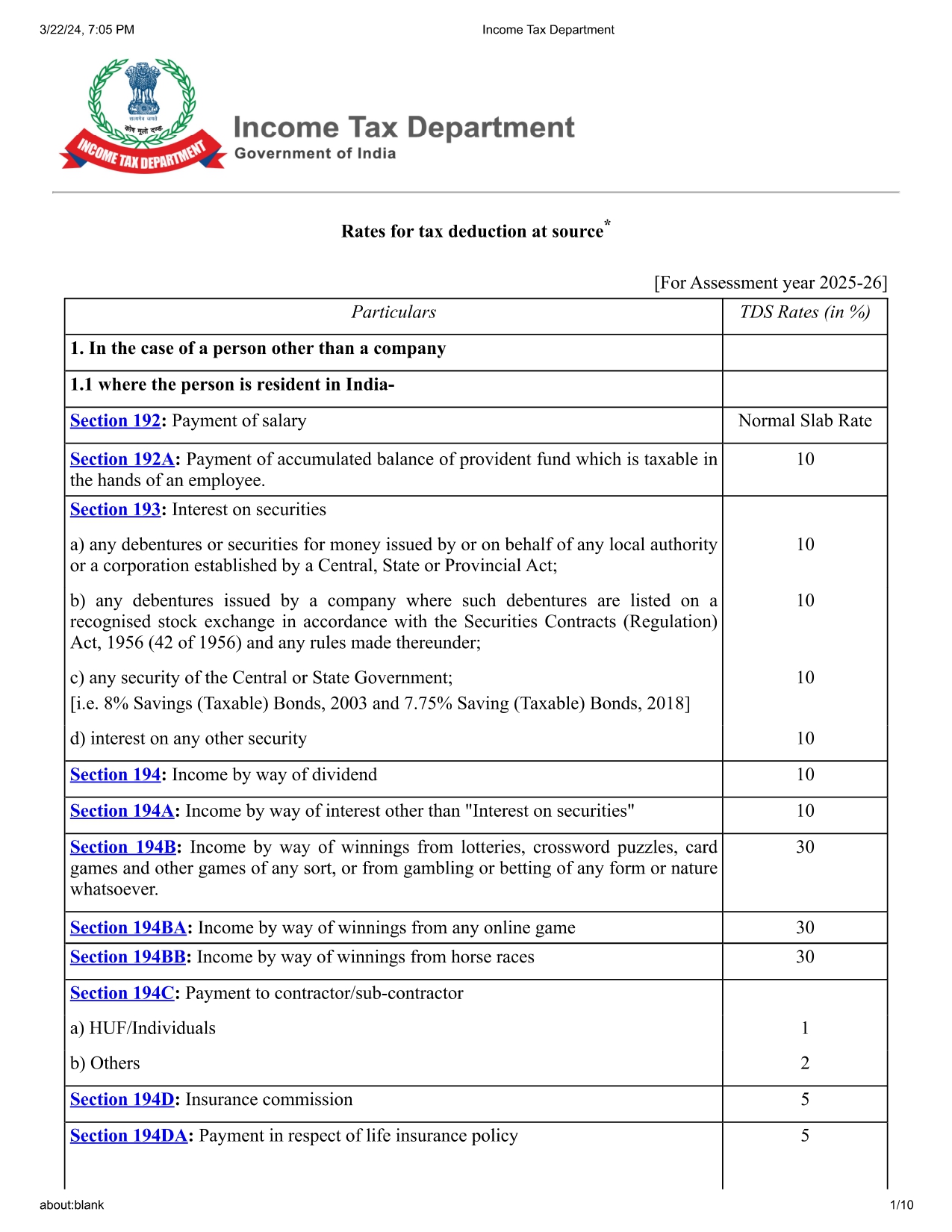

Tax Slab Rate Updated Ay 2025 26 Fy 2024 25 For Tds On Salary Filing taxes can feel overwhelming, especially with so many dates to keep track of. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026.

Source: economictimes.indiatimes.com

Source: economictimes.indiatimes.com

New tax slabs from April 1, 2025 Know tax slabs, rates under This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor. Filing taxes can feel overwhelming, especially with so many dates to keep track of.

Source: www.basunivesh.com

Source: www.basunivesh.com

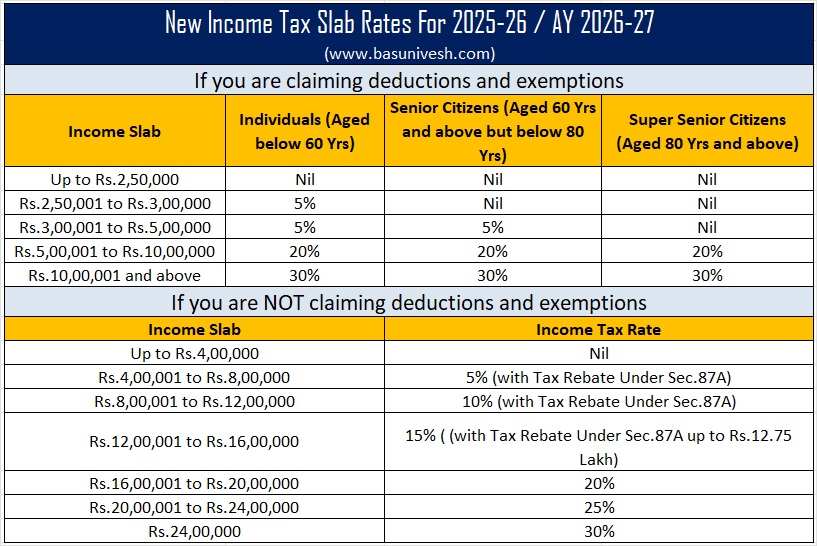

Budget 2025 New Tax Slab Rates FY 202526 A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor.

Source: www.news9live.com

Source: www.news9live.com

Tax Slab Rate AY 202526 for Salaried, Business Individual and A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor.

Source: moneyexcel.com

Source: moneyexcel.com

Download Tax Calculator FY 202526 (AY 202627) This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor. Filing taxes can feel overwhelming, especially with so many dates to keep track of.

![Tax Calculator FY 202526 Excel [DOWNLOAD] FinCalC Blog Tax Calculator FY 202526 Excel [DOWNLOAD] FinCalC Blog](https://fincalc-blog.in/wp-content/uploads/2025/02/income-tax-calculation-examples-2025-26-1024x576.webp) Source: fincalc-blog.in

Source: fincalc-blog.in

Tax Calculator FY 202526 Excel [DOWNLOAD] FinCalC Blog Filing taxes can feel overwhelming, especially with so many dates to keep track of. This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor.

Source: www.taxhelpdesk.in

Source: www.taxhelpdesk.in

Tax Slab FY 202425 and AY 202526 Important Pointers This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor. Filing taxes can feel overwhelming, especially with so many dates to keep track of.

Source: georgegpeterson.pages.dev

Source: georgegpeterson.pages.dev

Tax Calculator Ay 2025 26 Excel Sheet G. Peterson Filing taxes can feel overwhelming, especially with so many dates to keep track of. This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor.